Running a high risk business can feel hard. You deal with strict rules, high fees, and banks that often say no. Many payment processors reject your application without looking at your business. HighRiskPay.com changes that. It helps you get approved for a high risk merchant account quickly and easily.

If your business has faced rejection or frozen funds, you are not alone. HighRiskPay.com helps you keep your business running smoothly with a simple setup and friendly support.

What a High Risk Merchant Account Means

A high risk merchant account lets you accept card payments even when banks see your business as risky. Some industries have more chargebacks or legal issues, so banks avoid them. A high risk merchant account gives you access to payment processing despite these challenges.

You may need one if your business works in areas like:

- Adult entertainment

- CBD or hemp products

- Travel and ticket booking

- Online gaming or betting

- Credit repair and finance

- Subscription or membership services

If you fit into one of these categories, a normal payment processor might not work for you. HighRiskPay.com builds a bridge to help you accept payments safely.

Why Banks Call Some Businesses “High Risk”

Banks label some companies as high risk for a few simple reasons:

- Chargebacks: Too many refunds or payment disputes.

- Regulations: Complex or changing laws make banks nervous.

- International Sales: More fraud risk with cross-border payments.

- Recurring Billing: Subscriptions can lead to unplanned disputes.

- Credit History: Poor credit score affects approval chances.

HighRiskPay.com understands these risks and works to lower them so your business stays active and safe.

How HighRiskPay.com Supports You

HighRiskPay.com focuses on helping businesses that others reject. Their services are simple, quick, and reliable. You can apply online, get approved fast, and start accepting payments with confidence.

1. Fast Online Approval

The application takes only a few minutes. You can often get approval within 24 hours. No long waiting or confusing steps.

2. Multiple Banking Partners

HighRiskPay.com works with banks that accept high risk industries. This raises your chances of approval even if you were rejected before.

3. Chargeback Protection

The company offers tools that track and manage chargebacks. These tools help you spot problems early and protect your income.

4. Secure Payment Gateway

Your payment data stays safe with encryption. You can process credit cards, debit cards, or ACH payments on a single system.

5. Real Support from Experts

Their support team understands your business and answers questions fast. You can reach them anytime for help with setup or account management.

Simple Steps to Get Started

You can set up your high risk merchant account in a few easy steps.

Step 1: Apply Online

Go to HighRiskPay.com and fill out the short form. Include your business details and contact information.

Step 2: Review and Match

The team reviews your details and connects you with the best banking partner for your business type.

Step 3: Set Up Your Account

After approval, you receive instructions to integrate the payment gateway into your website or system.

Step 4: Start Accepting Payments

Once setup is complete, you can start taking payments right away. Funds go directly to your account.

Benefits of Working with HighRiskPay.com

Here is why many business owners choose HighRiskPay.com:

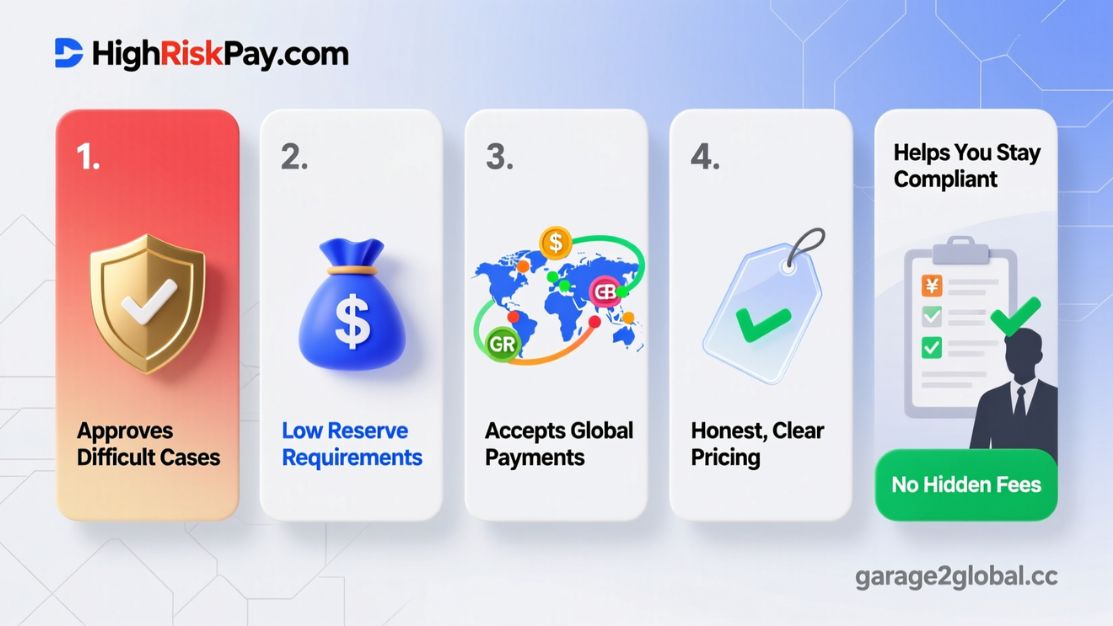

1. Approves Difficult Cases

They specialize in working with businesses that banks often reject.

2. Low Reserve Requirements

You can access more of your money instead of locking it in a rolling reserve.

3. Accepts Global Payments

The system supports multiple currencies and international cards.

4. Honest, Clear Pricing

You know your costs upfront. There are no hidden fees or surprise charges.

5. Helps You Stay Compliant

Their experts guide you through industry rules so your account remains active.

Common Problems High Risk Merchants Face

If you run a high risk business, you might face several issues:

- Many chargebacks

- High transaction costs

- Account holds or closures

- Limited processor choices

- Frozen funds without warning

These problems can stop your cash flow and hurt your reputation. HighRiskPay.com builds long-term stability for your business.

Example:

A small online supplement store faced constant chargebacks. HighRiskPay.com helped them set up alerts, fraud filters, and clearer product descriptions. Within two months, chargebacks dropped by half. The store now operates smoothly with steady cash flow.

How to Keep Your Account in Good Standing

Once you have your account, follow these habits to keep it healthy.

1. Be Clear with Customers

Post your contact info and refund policy. Make it easy for customers to reach you.

2. Watch Your Transactions Daily

Check your sales and refunds often. Quick action prevents fraud.

3. Act Fast on Disputes

Respond to chargebacks right away. Provide receipts or proof of delivery.

4. Keep Records Safe

Store all transaction and communication data for future checks.

5. Stay Honest with Your Processor

Tell them about any new products or changes. It prevents misunderstandings.

Good communication keeps your account open and builds trust with your processor.

What Makes HighRiskPay.com Different

Many companies claim to serve high risk merchants but fail when things get tough. HighRiskPay.com takes a different approach.

- They work with your business type, not against it.

- They build long-term bank relationships for you.

- They help you lower risk over time.

- They offer fast human support when you need it most.

This focus makes them one of the most trusted names in high risk payment processing.

Support for Small and Online Businesses

You do not need to be a large company to use HighRiskPay.com. They also help small online stores and independent sellers. If you sell CBD oil, travel services, or digital memberships, you can accept card payments safely.

Having a stable payment processor builds trust with your buyers. It also helps your business grow faster.

Things to Prepare Before Applying

Before sending your application, prepare these basic items:

- Business License: Proof of legal registration.

- Bank Statements: Usually from the last three months.

- Photo ID: To verify ownership.

- Secure Website: Use SSL and list your terms clearly.

- Estimated Monthly Volume: Helps the processor plan your rates.

Preparation makes your approval faster and easier.

Conclusion

Getting a high risk merchant account should not feel impossible. With HighRiskPay.com, you can accept payments securely, lower chargebacks, and focus on growth. They offer fair pricing, quick approval, and real support from people who understand high risk industries.

If your last payment processor said no, try HighRiskPay.com. They help you say yes to new opportunities and steady income.

Frequently Asked Questions

1. What does HighRiskPay.com do?

It helps high risk businesses get approved for payment processing accounts.

2. How fast can I get approved?

Most applications get approval within 24 hours after you submit your documents.

3. What types of businesses qualify?

CBD, travel, adult, gaming, subscription, and financial services are common examples.

4. Can I use my current bank?

Yes, you can link your existing account for deposits.

5. Does it help with chargebacks?

Yes, it offers tools and advice to lower chargeback rates.

6. Are there setup fees?

Fees depend on your business type. All costs are shared upfront.

7. Can I process international payments?

Yes, the system supports global currencies and cross-border cards.